Access Exclusive, Pre-vetted Investment Opportunities For Fast, Profitable Decisions

Investors join my network because they get consistent, vetted off-market deals before they hit the market without spending time or money on marketing themselves. I provide clear ARV comps, repair estimates, photos, and construction insight so they can make confident decisions fast. With strong relationships, creative deal structuring, and real knowledge of rehab and permitting, I reduce their risk and make every opportunity easier and more profitable. My network gives investors exclusive access, expert guidance, and a competitive edge in building wealth through real estate.

WE HAVE 40+ YEARS OF EXPERIENCE BUYING & SELLING

How We Source Acquisitions

We acquire real estate where distress, urgency, or operational friction creates pricing inefficiencies. By controlling direct-to-seller channels, leveraging data-driven underwriting, and solving the problems retail buyers avoid, we consistently secure assets below intrinsic value and deliver dependable opportunities to our investment partners.

Types of Deals We Source

Residential Opportunities

We source various residential investments from single-family homes to large multifamily properties, providing vetted, high-quality investment opportunities across all asset sizes.

Commercial Opportunities

We source small retail suites, multi-tenant strip retail centers, and select office space across key markets. Our focus is delivering well-vetted, high-quality commercial investment opportunities.

How To Choose Suitable Investment Properties:

Market

Study the market to understand trends and make wise decisions.

Analyze demand, rents, population trends, and comps so you invest only in areas where strong fundamentals ensure long-term profit.

Property Condition

Evaluate the property to understand its condition and value.

Understand neighborhood trends, demand drivers, job growth, rental demand, crime, school quality, zoning, and comparable sales/rents.

Exit Strategy & Risk

Define how you’ll win and how you’ll protect the downside.

Choose your exit path flip, hold, BRRRR, refinance and plan for risks so you’re never exposed without a clear, prepared strategy.

Cost Basis

Calculate your all-in cost with accuracy to guide decisions.

Include purchase price, rehab, holding costs, financing, fees, and reserves to set your true basis not just the final price tag

Investment Metrics

Run the numbers objectively so decisions stay clear.

Use NOI, cash-on-cash return, DSCR, cap rate, and ROI to judge if the deal meets your investment standards and long-term aim.

Decision

Decide with solid data so emotion never guides your choices.

If the metrics, market, and risk profile align with your criteria, move forward; if not, walk away immediately without delay.

Comprehensive Deal Evaluation Toolkit

This Toolkit gives both experienced and new investors a complete, streamlined system for analyzing opportunities with speed and confidence. It includes clear acquisition criteria, a step-by-step ARV and comps framework, quick rehab cost estimators, profit and return calculators, and a rental cash-flow analyzer. The toolkit also provides a red-flag risk checklist, funding and lending guidance, an inspection and walkthrough guide, an exit-strategy matrix, and a standardized deal review process. Together, these tools give every investor a simple, reliable way to evaluate spreads, understand risks, and make informed decisions on any property.

Recently Closed Deals & Track Record

Contact Information:

Email: [email protected]

Phone Number: (252)-339-6146

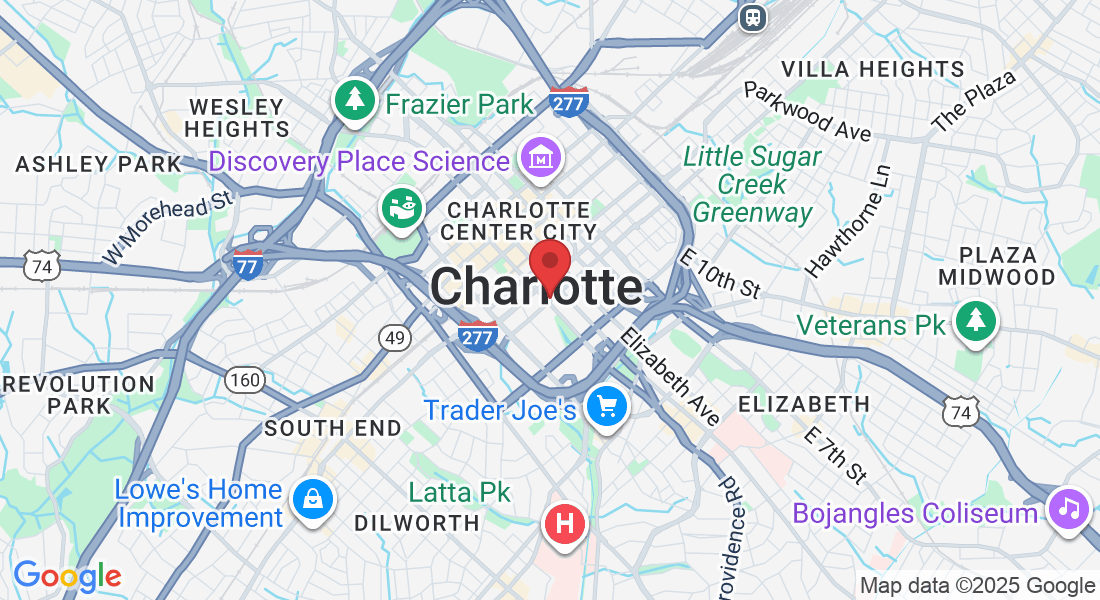

Areas of Operation:

North Carolina

South Carolina

Georgia

Virginia

Tennessee